IRS Name Change for Married Taxpayers in 2023

If you change your name after marriage or divorce, you must file your IRS tax return to match the name on file with the Social Security Administration (SSA) to avoid delays.

Delays could flow two ways:

- Processing your incoming tax return

- Sending your tax refund

Yet taxes and name change go beyond the SSA and IRS, extending to W-2s, 1099s, and bank accounts. You need full synchronicity, before, during, and after tax season.

This article will illustrate how best to complete and schedule your name change to prevent holdups, as well as taking corrective steps if an error occurs.

The IRS heard it through the grapevine

The IRS will know when your name has legally changed because the SSA will tell them after updating your social security card. This is an automatic alert.

Therefore, changing your name with the IRS starts with changing your name with the SSA. But the process does not end there. You need to warn your employers and banks too.

This SSA data exchange shares your personal information with the IRS and other federal, state, and private institutions. (And the IRS shares data right back.)

Note: You can use our online name change program to complete your social security to IRS name change paperwork, among others.

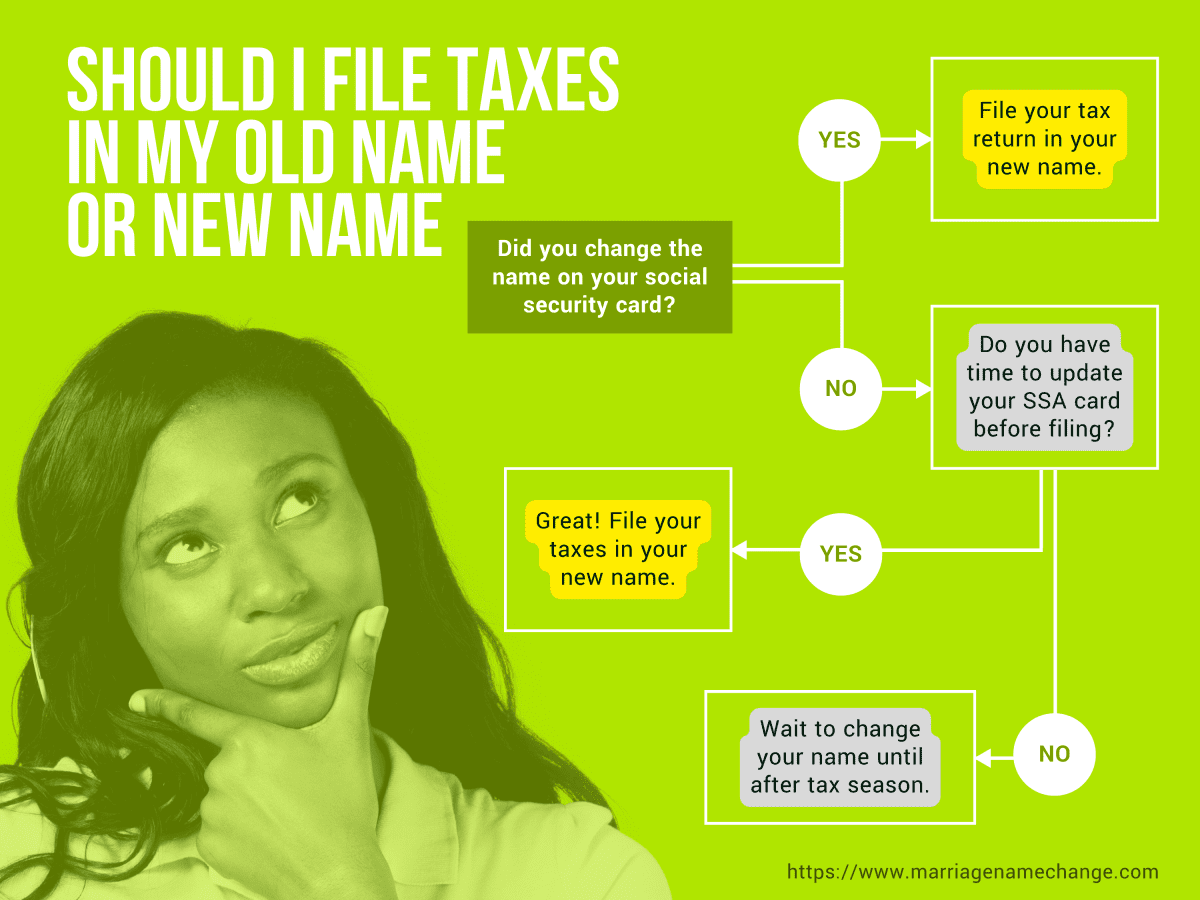

Name change before or after tax season

You should change your name before filing your tax return if you are sure your social security card, W-2s, 1099s, and bank accounts will show your new name.

Otherwise, it is safer to wait to change your name until after the IRS accepts your tax return. It is even safer to wait until after the IRS approves and deposits your tax refund.

Note: It takes 7 to 14 calendar days to get your new social security card by mail, so account for this time frame when filing your taxes.

When are taxes due this year?

Federal income taxes are due on Tuesday, April 18, 2023, at midnight, in your time zone. But the IRS extended the filing deadline for disaster-area taxpayers in the following states:

- Alabama, California, and Georgia — Taxes due October 16, 2023 for natural disaster areas.

- Arkansas — Taxes due July 31, 2023 for tornado and severe storm areas.

- Florida — Taxes due February 15, 2024 for Hurricane Idalia-affected storm areas.

- Hawaii — Taxes due February 15, 2024 for wildfire victims.

- Indiana — Taxes due July 31, 2023 for FEMA-designated storm areas.

- Mississippi — Taxes due July 31, 2023 for tornado and severe storm areas.

- New York — Taxes due May 15, 2023 for winter storm areas.

- Oklahoma — Taxes due August 31, 2023 for wind, severe storm, and tornado areas.

- South Carolina — Taxes due February 15, 2024 for Hurricane Idalia-affected storm areas.

- Tennessee — Taxes due July 31, 2023 for wind, severe storm, and tornado areas.

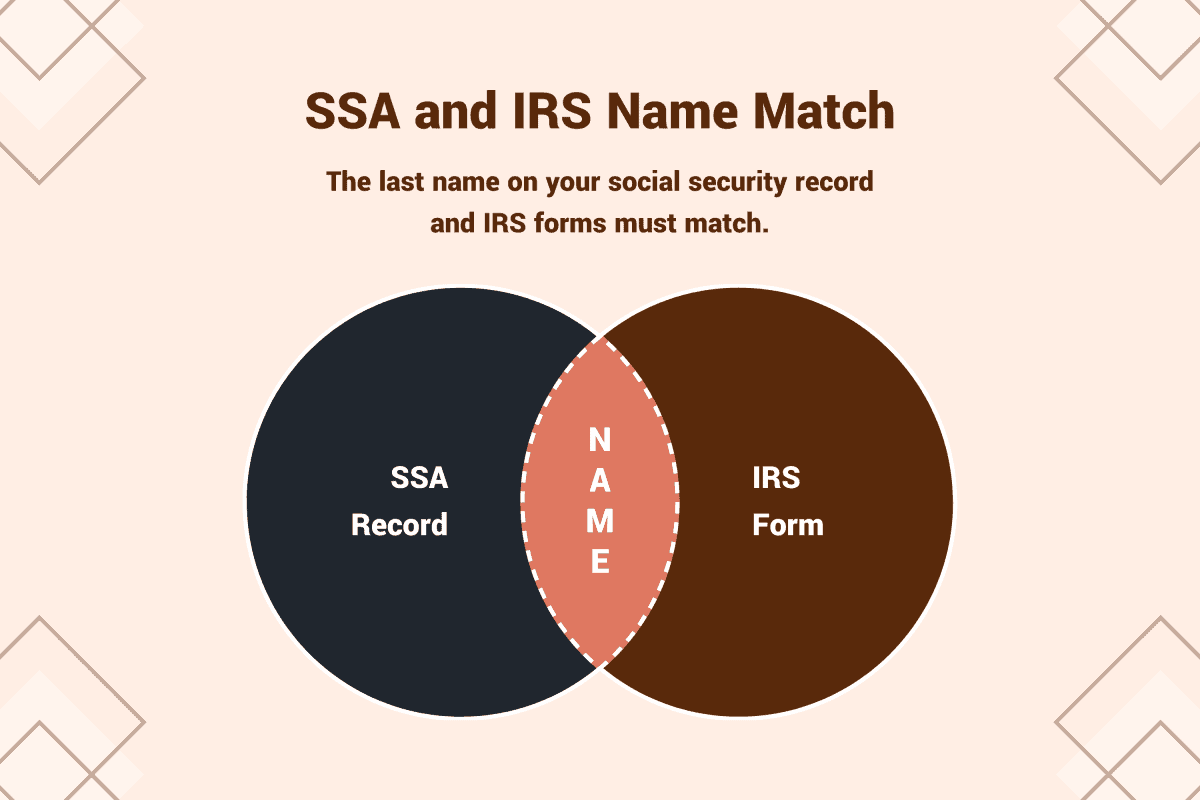

The IRS will verify your name change

The IRS will confirm the last name on your tax return matches the last name on your social security record by running a computerized query against SSA-provided datasets.

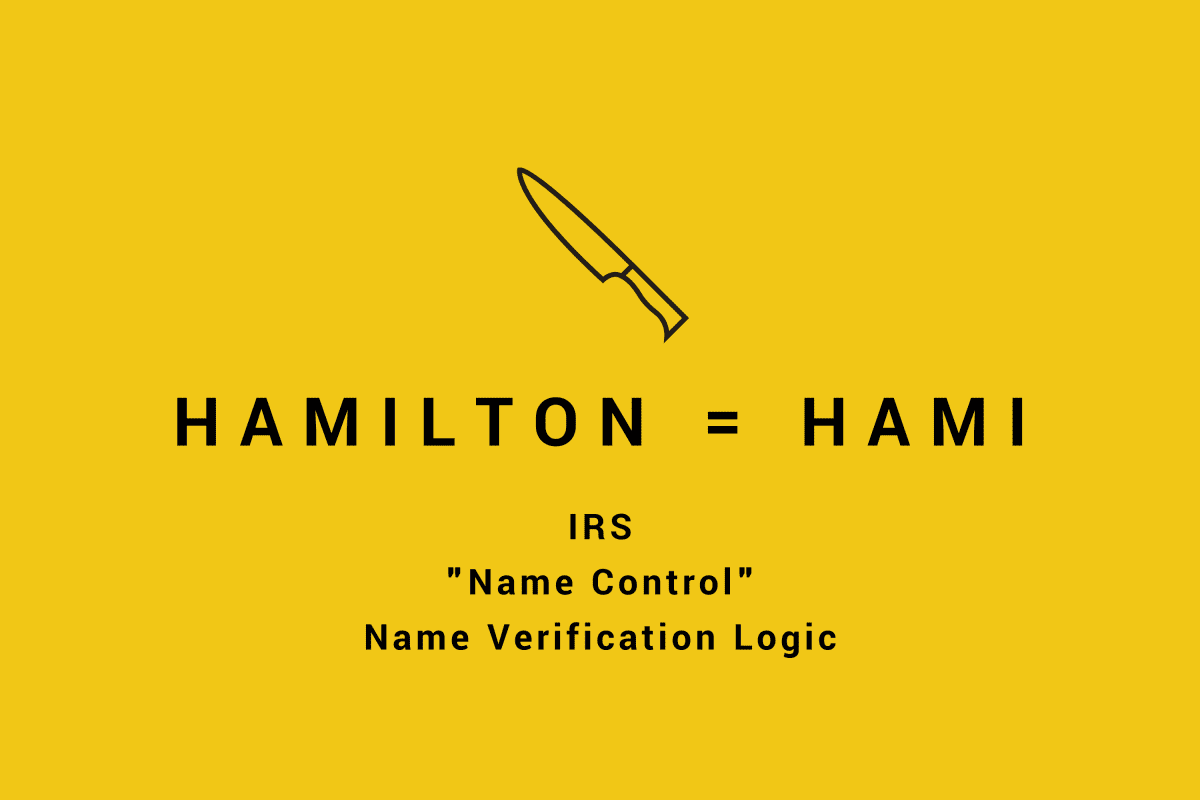

It may surprise you that the IRS will only try to match the first four characters in your last name and not your full name.

These four characters are called the "name control." Your name control may contain letters (A-Z) and hyphens (-). (They will strip away other characters.)

IRS name control matching is very lenient:

- For example, if your last name were Brown, your name control would be "BROW."

- Yet if you spelled your last name Browning, your name control would still be "BROW."

Your name control is used to match against your social security record along with your social security number (SSN). Mismatches can hinder processing.

Note: The preceding name control rules are specific to a person's name. Business names extend the above rules to allow ampersands (&), exclude the term "DBA," and ignore the word "The" when used at the start.

Advantages of e-filing and name change verification

Electronic filing (e-file) offers a key benefit over mailed paper filings: real-time name validation. If the IRS reports a name mismatch, you can try again until you fix the error.

According to the IRS, for Fiscal Year (FY) 2021, electronic filing made up 90% of the 151.1 million individual tax returns filed.

What about spouses' and dependents' names?

Social security number and last name verification will apply to everyone listed on a tax return, including the primary taxpayer, secondary taxpayer, spouse, and dependents.

Any name discrepancy will trigger a rejection. An e-file name control mismatch error will prompt you to recheck your input data and try again.

What about accented characters?

If your name has accents or diacritical marks, file your tax return using the letter equivalent. For instance, if your surname were Gómez, spell it Gomez instead.

Notice how the "ó" becomes "o" in Gómez. The name control becomes "GOME."

What about apostrophes?

It does not matter whether you keep or drop an apostrophe in your name on your tax return. The IRS (or your tax preparation software) will do a silent removal.

If your last name has an apostrophe, IRS computers will cut it. For instance, if your last name were O'Leary, the IRS will convert it to OLeary with a name control of "OLEA."

Unlike the IRS, SSA records allow apostrophes in last names. IRS systems account for such disparities, so this will not provoke a name mismatch.

What about short last names?

Your name control can have less than four characters, but it must start with a letter. So a last name of "Li" would cause a two-letter name control of "LI."

What about hyphenated last names?

If your name is hyphenated, the IRS will use the first four characters of your hyphenated name (including the hyphen) as your name control.

Example 1: Dangling hyphen

For instance, if your last name were Lee-Mitchell, the IRS would match against "LEE-" with the hanging hyphen as the fourth character of your name control.

Example 2: Middling hyphen with apostrophe

However, if your surname were O-D'Angelo, the IRS would use "O-DA" as the name control—keeping the hyphen yet dropping the apostrophe.

What about last names with spaces?

If your last name has a space, the IRS will remove it. For instance, if your last name were Van Hollen, the IRS will flatten it to VanHollen to achieve a name control of "VANH."

You do not have to remove spaces from your name on your tax forms or tax return. The IRS will remove them during processing.

Name and address change

If your home mailing address has changed, file IRS Form 8822 and note your old and new name. Filing Form 8822 should not wait until tax season. Do it upon moving.

IRS-sent mail and paper tax refund checks will get lost if you do not alert the IRS of your new mailing address, which can be a home address or P.O. Box.

Employees and W-2s

Tell your employer or HR department when you change your name. The name on your W-2 form must match the name on your social security record.

Your employer may need to see one proof of name change:

- Updated social security card

- Updated driver's license

- Updated passport

Or just proof of authority to change your name:

- Marriage certificate

- Divorce decree

- Court order

Filing taxes with a W-2 that is under the wrong name can lead to delays in processing your tax return and the receipt of any tax refund due.

What if your W-2 shows your old name?

If your employer issued you a W-2 under your old name, contact them for a corrected W-2 in your new name. They are required by law to comply.

Getting a corrected W-2 applies to current and former employers. If they refuse your request beyond February 2023, the IRS can force their hand with a Form W-2 complaint.

Accountants and employers can verify employee names and social security numbers online using the free Social Security Number Verification Service (SSNVS).

Self-employed freelancers and 1099s

If you are a self-employed freelancer, gig worker, side hustler, affiliate marketer, or independent contractor, tell your associates to update your name on any IRS 1099 form issued.

If you receive a 1099 in the wrong name that does not match your social security record, processing of your tax return and tax refund could get delayed.

What is a 1099 form?

A 1099 lists how much money an entity or person paid you during the last calendar year. (1099s are not for employers and employees—those use W-2s instead.)

For instance, if you owned a website that promoted ACME Inc's products or services for commissions, then ACME Inc. would issue a 1099 form.

In this scenario, ACME Inc. is the "payer" and you are the "payee." You should get your non-employee 1099s by mail no later than January 31st:

- One 1099 copy to you

- One 1099 copy to the IRS

A payer could be anyone who sends you money:

- A client

- A friend

- A company

- But not an employer

Will you get a 1099 if you made little money?

Payers are not required to issue 1099s to non-corporations whose earnings or payouts were below $600 for the prior year.

Although payers can issue 1099s for payee earnings below $600, they often do not because it means more tax paperwork and burden for them.

Correcting the wrong name on your 1099

The name on your 1099 must match your social security record, same as a tax return, and same as a W-2. Otherwise, delays may ensue.

1. When you find an error

If you notice the wrong name or information on your 1099, tell whoever issued it to send a corrected 1099 to you and the IRS.

2. When the IRS finds an error

If the IRS spots a mistake on your 1099, they will alert the payer who issued it. The payer should contact you for a correction and send the updated 1099 to you and the IRS.

Update your bank account to match

You may face trouble cashing checks or receiving ACH direct deposits if the name on your check or direct deposit does not match the name on your bank account.

This problem goes beyond tax refund checks and direct deposits. It can affect your regular paychecks too, whether paper or direct deposit.

But your bank routing and account number is right

Here is an eleventh-hour nightmare sequence of events:

- Social security card, updated

- Employers, notified

- Clients, notified

- W-2s, done

- 1099s, done

- Tax return, done

- Name on bank account, unchanged

- Bank routing and account numbers, unchanged

Good enough, right?

- No, that is not good enough.

- You needed to tell your bank your new name.

ACH direct deposit payments may get rejected by your bank because of a name mismatch, even when your routing numbers and account numbers are correct.

Yes, that's numbers, plural, as the IRS allows you to split a tax refund direct deposit into up to three different bank accounts owned by you or your spouse.

Deposit rejection is harsh, but understandable:

- Rejection avoids depriving the true recipient of monies due.

- Rejection avoids a time-consuming investigation.

- Rejection avoids reversing a settled deposit.

- Rejection avoids IRS intervention.

You forgot to update the name on your bank account

The IRS will mail you a paper check if your bank rejects a direct deposit tax refund due to a name mismatch between the endorsed name and account holder's name.

In order to cash or deposit your incoming paper check, you must still change the name on your bank account to match the check's "pay to the order of" name.

You can use the IRS' Where's My Refund tool to check your tax refund status.

Tip: Your bank might accept a check in your old name if you present your marriage certificate, divorce decree, or whatever document prompted your name change.

Conclusion

The only thing scarier than doing your taxes is doing them with the wrong name. One name change inconsistency can invite chaos, causing tax return and refund delays.

So if you are transitioning to a new name, make sure you update it everywhere that matters, from your social security card, W-2s, and 1099s, to your bank account.

Your future self will thank, your accountant will thank, and the IRS will thank you.

I got divorced in October 2022. The judge granted me the restoration of my maiden name, however I felt it was too close to the end of the year to change my name with SSA. I filed under my married name with plans to change it after the tax season. Will this be an issue?

This is fine and avoids a potential delay due to a name mismatch.

I am on Medicare and I have remarried. Can my husband claim me on tax return. I have no other income so I won’t be filing a separate return. Thank you for your response.

Yes, your husband can claim you by filing "married filing jointly."

I have been filing for years as single head of household. I got married but we seperated the next day. I never changed my last name. Can I get in trouble? Someone told me I have been doing it wrong all of these years. Please help what do I do

No, you won't get in trouble with the IRS for not changing your name.

All last year I was single. Just got married in Jan this year. Can I file in old name? Single? I have changed my name.

Hi Hope. File using the name that's on your current social security record. If you've changed your name on your social security card, file your taxes in that changed name. Otherwise, file in your single name.

hi there, i recently married and added my husband’s last name to mine. (firstname maidenlast hislast). social security has been notified. my workplace uses only the second of the two last names, which is his last. is it legal to use only one of the two surnames?

Hi Brooke. When your workplace reports your information to the IRS, they must use the name that matches what's on file with the Social Security Administration. As long as they're doing that, it's fine for them to informally use only the second surname.

Hi! I got married February 7th, 2021 and now I need to file taxes , my SS shows my married name but my w-2 has my maiden name since at that time I was single. Is it ok to send my w-2 with my maiden name ?

Hi Pris. You could cross out your maiden name and write in your married name on the W-2. If you'd rather not mark your W-2, you can attach a note explaining your name change.

Hi, I have a question? I already file a tax return at the first week of February 2021 with my old name. Because of married then I changed my first name and last name. Which was in March 1st week 2021 at social security office. Now I had new social card with new name. So I’m wondering do I get my refund or not? At this time IRS is not accepted in person visit and phone calls are busy at all. So can I have an idea about it. How I contact if needed?

Yes, the Social Security Administration would have notified the IRS of your name change on your behalf.

By mail or telephone. The best time to call the IRS is first thing in the morning, when their phone lines open at 7am EST.

Will it can be a issue of name mismatch to IRS because I file with my old name. Or could be delay to get refund?

Hi Sadeep. It's unlikely you'll face any problems or delays. The IRS should perform a seamless transition when notified by the SSA of your name change. You shouldn't have to do anything.

I still have my maiden name on my ss card, but all my other info is in my married name. Can i put my maiden name and my married name on my return? The problem i have is if they mail me a check. I cannot cash it.

Hi Cherie. The IRS will use the name that's on your social security record. As for cashing a check in your maiden name, that should be workable with your bank as long as you can provide documentation showing your prior name along with a copy of your marriage certificate.

Married 2005 changed name to his. divorced 11 months later in 06. I took my maiden name back in the divorce. Changed my name with DMV and changed my name with social security. Both my ID and SS card reflect my maiden name.

Taxes are filed for 2019 year under my maiden name. I call to check on them. They are holding my returns because they have me with my married name still. I have an appointment to show my legal name next week. But why would they still have my married name

Hi Renee. Could an employer still be reporting your prior name in filings? That could trip things up.

When you update your SS card, they alert the IRS. This typically isn't a problem, but it's not guaranteed in every instance. The situation you described appears to be in the minority of cases. Hopefully it will be resolved with expediency as this is not the norm.

I got married june 2019 changed my last name August 2019 . Filled my taxes under my married name 1/29/2020 and they STILL are holding it due to “review” for my last name change. So changing it in time didn’t help me any . Why is this ?

Hi Tee. Did you change your name with the SSA before filing your taxes?

Yes . August 2019

Hi Tee. This normally shouldn't be a problem then. When you change your name with SSA, they notify the IRS on your behalf. This is common. Did they provide details of what is under review? Could any reported W-2s refer to your old name?

No the only info that they provided was that it was under a quality assurance review due to my last name change . Nothing else . And all 3 of my total Ws had the proper last name . It has now been 2 weeks since I filed and I have received no letter I only know this because I called and this was all they said to me about the review .

Hi Tee. At best you can contact them to ask about the status and if and when you'll receive a determination letter.

I filed my taxes January 27. They wee accepted same day. On January 29th changed my name to my married name. Should i call the irs to update them or anything

They were accepted using my maiden name

Hi Bree. You're fine, as they were already accepted. When the SSA processes your name change, they'll notify the IRS on your behalf.

I got married in June, changed my name with the SSA. But never changed my name at work will my w-2 still have my maiden name on it and will I have issues filing

Hi Ashley. It could cause a delay. You're gonna want to get your W-2 updated.

I got married may 2018, I changed my name January 2019. I am filing my 2018 taxes, do I use my maiden name since I changed it in 2019 or use my married name ?

Hi Madison. If you've changed your name with the Social Security Administration, they would have automatically alerted the IRS of your name change. In that case you'd file in your maiden name.

When I got divorced 6 months ago I did not want to change back to my maiden name at that time can I change back to it now

Hi Jackie. You wouldn't be able to do it if your final divorce doesn't say that you can. You can try contacting the court/judge to get it amended.

I need to file my 2017 taxes but in 2017 I had a different last name and was married to someone else. If I file my 2017 taxes now (in 2019) do I need to change my last name and spouse info since I no longer have the same last name and married to someone different?

Hi Angela. You'd file with your current name. They maintain a record of prior names for reference.

My husband and I got married April 2018. I changed my name with every facet of government and did what I was supposed to do and have been using my new last name since then.

I filed my taxes under my new name, waited 3 weeks and finally called because my refund wasn't here yet. They told me that they had to authenticate my married name even though SS already sent me a new card with my new name!!!!

I had plans to go on a non-refundable cruise with my sister for her bachelorette party and now I cannot go because they said that they will have to issue me a letter stating what the authentication is and that it will take an additional 9 weeks to get my refund!!

I work for USPS and it's a shame that the IRS doesn't have my correct name! What can I do and what options do I have? I did everything I was supposed to and still getting screwed!!

Hi Alexis. When you update your name on your social security card, the IRS is automatically notified. There's nothing much beyond that for you to do. You may want to consider visiting a local SSA office and interfacing with an actual agent.

I got married last year but i havent gotten around to changing my name. All of my documents are still under my maiden name. My question is, should I file my taxes under my maiden name and wait until after my tax return to change it, or should I go to the SSA to finally change it before I file and then file under my new name? I want to avoid any kind of delay or issue. Thank you!

Waiting to change your name until after your taxes are done is the path of least resistance.

I got married in march of 2018 and me and husband file jointly,plus my last name is change as well.Will that slow down the process of my refund?

It won't make a difference.

Hi. I got divorced February 2018 and I immediately changed my name in SSA, DL, work, banks, etc. My W-2’s are all in my maiden name now. I filed my taxes two weeks ago and has not received any updates yet. I called IRS before I e-filed my taxes if I am going to have an issue and they said once I file my taxes, they should be able to verify that my name has changed with SS. Is there a reason why it is taking longer than anticipated? Appreciate your response.

Name mismatches can often be dealt with through manual reviews. You'd have to phone them to determine if there's a problem processing your application as-is.

I didn’t file my 2017 taxes and was married … durning 2018 I got my divorce and my last name went back to my maiden name … my ssn card has been changed to my maiden name along with everything else but what do I put on my tax papers for 2017 ?? Married name or maiden name ???

Hi Chrystal. You'd use your current, legal name.

I got married 122117 but never changed it on my dl. But I did change my name with ssa. Should I be worried.

Hi Bonni. Some states require your driver's license be updated when you change your name, but the consequence for not doing so varies between nonexistent and a miniscule fine upon renewal. If you don't change your name on your license now, you'll have to when it comes time to renew.

Hi I've been married almost 12 years. I just recently went to the DMV to hyphenate my last name in December. I e-filed my tax return on 1/30/19. The SSA sent me a letter after I filed. I went to change/hyphenate my name on my ssc, but my taxes were already filed. Will I have a problem with my return. The status on my return is not changing? My w-2s have my maiden name only, no hyphen.

Hi baseemah. It's doubtful you'll face a problem with your return as your names matched at the time of filing.

Hi!

I got married in November 2018. I have not changed my name with the Social security yet. I filed taxes under my maiden name, am I able to change my name now? My refund has been accepted but not yet approved. I wanted to wait until after we filed to change it so there wasn’t any mistakes or delays, just curious how long i should wait, Thanks!

Hi Brittany. You don't have to wait. You can change your name now.

Hi there,

I got divorced in 2018 and changed my name back to my maiden name. I changed it with SSA as well. However, I changed jobs and one W-2 is under my maiden and one is under my former married name. My bank forms as well as mortgage forms are also under my married name. Will I need to get all of these amended. I'm afraid it will take months to deal with the State (my employer), and all of the banks. How likely is it to get pushed through with the mismatch?

You can cross off the maiden name on the old W-2 and write in your maiden name. You could also attach a supplemental letter explaining your situation.

You'll have to contact them regarding the necessity of updating your name on file.

my husband and i got married April- We have had our issues and are currently separated ( I plan on filing for divorce this year, hopefully soon). He is going to file single HOH with our daughter (as he did before) .Will That affect me? We didnt change name or anything so I am not sure what to do

Hi Lilly. Whether or not you changed your name doesn't affect filing. Head of household filing can be applicable if legally separated. It may affect you if you're both taking advantage of tax benefits associated with your daughter. You'll have to get in touch with an accountant for further details.

If I filed married but I never changed my maiden name will it cause me problems with my taxes?

Hi Brithany. There won't be a problem as long as you file in your current legal name.

Hi, I got married in 2014 and changed my name with ss immediately. I have been filing my taxes in my previous marriage last name for the past 4 years. My 1099 have both names on it. I want to file taxes this year using my legal last name. Will this be ok with IRS?

Yes, it's fine.

have not changed my last name but when I file for my social security they asked me was I married and I said yes for 7 years. can I file jointly if I did not changed my last name.

thanks: estelle

Yes, you can file jointly. Changing or not changing your name doesn't affect your filing status.

I changed my name at the Social Security office like I was supposed to after a new marriage and received a new social security card with the correct name and the IRS still puts the refund check in my previous married name! We file with my current last name, but they issue the refund check in my husband's name and my first name with my last married name.

I can't seem to get anyone to change this and it's a huge hassle to deposit the check every year. Our credit union never wants to accept it because of the different last name…. which I have not even had legally for the past 8 years because I went back to my maiden name before getting married again. Any suggestions?

Hi Celeste. You may want to visit your local IRS office. Bring your marriage certificate, social security card, and tax documents with you.

If you prefer not to go in person, you can write a letter first, but speaking to someone directly may be more expedient.

I got married jan 29th 2019 and just got my w2 that has ny maiden name on it. I have not changed my name on my ss card yet. Can i still file under my maiden name then change to my married name later? Also do i file as married since i was married after the 2018 tax cut iff or do i file single since i was single in 2018?

Yes.

You'd choose married filing jointly or married filing separately.

I have always filed head of household with my two children. However, I am planning on taking my husbands last name, for school purposes and for the kids. Can I still file head of household with married last name?

Yes, your filing wouldn't change because you changed your name.

Hey I got a question my wife and I have been married for almost 9 years we never changed her last name on ss card. We went ahead and did it this nov 2018 we also completed the irs form 8822 for address/ name change we completed it and got confused where it asked for the signature it states that if your last return was a joint return your spouse must sign we did a joint return last time and we had to use her maiden name beins we never changed her last name on ss card. We signed the 8822 with her new married name will irs accept the 8822

Yes, you're fine.

Hi, I’m getting married this December 18th and I decided to do some research and I came upon this. We are looking forward to our tax return as a married couple to help us move into our own place. Im just finding out about the whole tax return process thanks to this blog. But, I’m still confused on some parts. So, do I need to change my last name right away in order to file as married? & if the answer is yes, does that mean I need to contact my employers to change my last name on my W-2 forms before I file with my married last name ?

No, your name change (or non-change) doesn't affect your ability to file as married.

Yes, you'll want the W-2s to match the name you'll be filing with.

Hi,

I am living in Australia and updating my surname with SSA. How long should I wait to file my tax return to give SSA enough time to process the change and prevent name mismatch? My closest SSA Benefits unit is in the Philippines so I am mailing my documents there. Also, does updating to SSA also update to FinCen (for filing FBARs)?

Thanks so much for your help.

You won't know for sure if your name is changed until you get your new card or get in touch with the SSA to receive confirmation of the change. Processing time, once your application is received, is typically one to two weeks.

My closest SSA Benefits unit is in the Philippines so I am mailing my documents there.

No.

Hi ive been married 3 years ago without my husband here in USA but never been change my husband last name in my id,sscard,in my work,w2,in my bank,etc.but i have a,son who is my dependent.and now my husband is here got a job and hes working..is it will be affect when we file income tax??..what should we do?..can we file both without using my husband lastname??..can wr still get refund??

Hi Jho. Your name change, or lack thereof, won't affect your filing. You'll want to make sure you file using your current legal name.

You mean legal name ??my last name?? Or my husband last name?

Hi Jho. I was referring to your last name, not your husband's.

I think in screwed we was married in Nov and I was told only had to file together if was over 6 months ago and just now seeing all of this we didnt live together all last year and he file single head of household and idk what to do cause they've been reviewing it forever now and it was an honest mistake cause I was told diff and didn't double check !! my name wasn't changed or anything

please help idk what to do cause I don't want them taking his tax check cause I owe money and it wasn't his fault nor did we live together or anything !!! idk why it's taking so long if their auditing it or what !!?

Hi Lili. You may consider contacting the IRS directly to explain your situation. Not everything is absolute when it comes to the IRS. They do have abatement procedures in place that they can apply on a case-by-case basis.

If you feel your situation is precarious, you may want to consult with an accountant or tax lawyer.

I've been married for several years now, and each year my return from my state comes with my my maiden name on it! I've changed my name with SSA, Driver License, Bank Acct, W2, anything I can think of but the state still returns with my maiden name. What can I do?

Hi Elle. You can contact your state's tax office to update their records. They may require it be done in writing.

Hi, I got married in August, and have not changed my name with the SSA or on my ID. All of my student tax forms and w2s also say my maiden name. My only question is if my bank has my married last name on the account, will this cause any issues? I know that I am in a time crunch here, and by your previous replies, don't think I have time ffor everything to be changed and process before we need to file. What is the best thing to do? Thanks for the help!

Hi Ariel. The name on your bank account is separate from any SSA or taxes issues you're facing. One thing to be concerned about is if your bank may reject any incoming tax refund if the ACH name doesn't match the name on the account. You'll have to get in touch with your bank to determine that.

Hello,I got married this past October 2017, but have not had the chance to get my name changed at the SSA. My workplace has already changed my name, so my health insurance and W2 have my married name. Will that mess up anything when I go to file my taxes?

Hi Helen. It could result in a delay considering the name submitted to the IRS won't match what's in their records, nor the SSA's.

I got married feb. Of 2017 but my wife hasn't changed her last name we both filed married separate returns and she file married separate and qualified for HOH for filing my children that lives with us but we got red flagged for poof of marriage and poof of relationship to the children is this normal ?? Did we do anything wrong??

Hi Brandon. Whatever the reason for the flagging, it wouldn't be due to her not changing her name.

Last year was mine and my husbands first year of being married and filing our taxes together. My last name was still my maiden name since i hadn't changed it yet. This year when we filed out last names matched and we were flagged by the irs and have been put on a 9 week delay. They say that it was because I changed my last name. It was changed thru the social security office. Is this normal?

Yes, as the IRS is notified of names changes by the SSA.

Hi I got remarried in September but have not changed my last name thru SSA or my drivers licence so do I still file married and what about my last name? They probably don't even know I'm married. Can I just file as usual?

Hi Lydia. You'd still file married. Your last name doesn't matter in this situation. You can either file married filing separately or married filing jointly.

I have changes my name at the social security office. My ss card has my new name on it. My state issued drivers license has my new married name on it. My everything says my new married name… 7 years now… my taxes get rejected everytime! They make me sign my maiden name. I go every year and ask them to fix it. They say there is nothing to fix. It's in the system rigjt. What can I do?

Hi Amber. The IRS mirrors what the SSA has on file, so it appears their records may not be in sync. You can visit your nearest social security administration office and ask them to look into it.

My wife and I got married last year. We haven't done anything with the SSA and and she hasn't changed her name yet. She submitted her federal tax return (haven't submitted mine yet) and we were filling separately. She got a notice that it was rejected for "R0000-503-02" saying her spouse's name and SSN (mine) didn't match their records. The info we put in is correct, so the only explanation is that their records still show her as unmarried, which is understandable since we haven't gone to the SSA yet. If their records still show us as single and unmarried, should we file that way? Because filing separately while married got rejected.

Nevermind! Upon reviewing it there was a single digit off on my SSN on her return!

Hi, so I got married last year… I just changed my last name from my maiden name to my married name in late January 2018, and I just got my w2 forms around the same time, and they have my maiden name on them… And since I no longer work for them and haven’t since November of 2017, I didn’t change my last name with them… I wasn’t even thinking of taxes when I changed it – if I had, I would have waited! What do I do? Which name do I file under?

Hi Ellie. You'll want to file under your married name. You can contact your old employer and ask for them to send you a corrected W-2, which is referred to as a W-2C forms. If they're non-responsive or unwilling to assist, you can phone the IRS and they'll contact your employer on your behalf to request a W-2C be issued.

I got married January 24th 2018 I went to change my last name with SSA on 1/29/2018 they said it would be fine to file my taxes within 48 hours well I went to file them last 72 hours later and it rejected my new last name and would only accept my maiden name. IRS shows with maiden name it is accepted. Should I be ok?

Hi April. If it's been accepted, you should be good to go this time around.

Hello, I am an independent contract worker. I changed my last name with the SSA last week (January 2018). Do I need to contact my clients so that my 1099 reflects my new married name? Or can I submit my return with my maiden name since that was my legal name in 2017?

Hi Deb. Your tax-related documents should be in your new name, as that's what the IRS will reference after being notified by the SSA.

I filed taxes on January 15 with my maiden name. I got married in October, so I went on January 24 to change my name with SSA. My return is showing Accepted through IRS site. Could it be rejected even though my name was still legally my maiden name when I filed?

No, it's already been accepted, so it's a done deal.

I got married December 2017 and changed my name in January 2018, I have received a new SSC with my married name on it, but all of my tax documents have my maiden name, will there be an issue with filing? I haven't updated my new last name with my employer or school yet.

Hi K. It's possible your tax filing may be delayed or rejected due to a name mismatch. The IRS may be able to resolve it internally without your input, but it's not guaranteed. You'll want to make sure your tax documents are in sync.

If I didn't change my name and didn't want irs know I got married would that be possible even if I got married in a different state.

Hi Margret. If married, you can either file married filing separately or married filing jointly. Answering another way would be incorrect.

I have a question, so I was in school last year and on there it has my maiden name and not my married name on my FAFSA, will this make my refund prolonged because of different last names on my FAFSA and on my SSC due to me being married? Also I have a employer that I no longer work with that has my maiden name on my W-2 will this cause a problem as well?

H Simone. You'll want to contact FAFSA, as the name on your FAFSA should match what's on your social security record. Same goes for your W-2. There's a name mismatch there to be corrected.

Hi

I just got dissolved/divorced JAN 9, 2018 and requested to go to my maiden name.

Would I still be filing as married but seperated?

If I want to change my last name with SSA, can I do so in the next few weeks?

if I plan on filing my taxes in february… will I file with my married or maiden name?

No.

Yes. You can make the change when you have an original or certified copy of your divorce decree in hand.

You'd file with whatever name the SSA has on file.

My wife of 7 years uses her exes last name and filed taxes under that name now she wants to change her name to my last name can she do it without any penaltys

Yes, she can change her name without penalty.

My W2 has my new married name but havent changed my name with the social security office how will that affect me filing my taxes. We both have kids frok different relationships he has sole custody of his daughter and i have sole custody of my son. We have been married 4 months how should we file.

Hi Kendra. You're going to have a name mismatch with your W2, which isn't good. After you get your name changed with SSA, the IRS will be notified and you should be good to go.

Hi, I married in 1990 and didn't legally change my name. However I did use my husband's surname on checking accounts, IRS docs etc. I divorced in 2009 and again didn't make any changes as I had a daughter and wanted to keep our names consistant. She is now grown and I would like to go back to legally using my maiden name as my surname. Since I never filled out any paperwork can I just start using it again, like how I just started using my married name? Thank you

Hi Kerry. Yes, you can use it as you normally would.

I got married but haven't changed my names on anything.. Will that be a problem when i file for taxes?

Hi Claudia. You'll be fine as long as you file your taxes in your legal name.

Hi..my daughter was married to an Englishman, in England, August of 2016. She filed her 2016 Federal tax return before the April deadline, in her married name. She had already changed over her DL, passport, etc., but forgot to change her name with Social Security. The IRS told her that her return was rejected because she hadn't changed her name with SS, so she went to the local office, completed the name change, and after about a week she received her new SS card in the mail. She then contacted the IRS to find out if they had received the update and to find out when her refund would be processed. She was told it wouldn't be processed until July, and now that it is July, she's called multiple times and each time she does, she gets a different response. Here's a sample of the responses: "It isn't showing it's been processed" "There isn't a hold on it, it just hasn't been done yet" I input your name change manually so it'll be processed" "It's still showing your maiden name" "I'm not seeing the name change with the social security administration". Any thoughts, please? Thank you

Hi MC. Your daughter may want to go back to the local security office for assistance to determine if there was a problem with their alerting the IRS to the name change.

Hi, i got married in12/29/16 and had my name changed with SSA on 04/14/17. I have received my new SSN with my married name and the date i requested the change reflects in the card also (04/14/17)I believe IRS will automatically be updated but i am not sure how soon will their record be updated. However, my 2016 ITR was filed on 04/17/17 (3 days after name changed with SSA) and has my MAIDEN name still, as well as my W2 and 1099..will there be a problem on that? i will

really appreciate your reply..Thank You.

Hi Rowena. If a name mismatch occurs, it can be manually reviewed instead of arbitrarily rejected. Manual reviews often catch these things, so if you're not alerted to a problem, there isn't a problem.

Hi,

I got married in February of 2017. I also changed my name to my married name in March. I have already filed my taxes but I filed my taxes under my maiden name and single. All of my W2's and 1099 show my maiden name. Will there be an issue with my taxes?

Hi Sofia. If there's a name mismatch, which it appears there will be, the return will be flagged for manual review. When a human looks at it they can probably tell the mismatch is due to a name change, so it may be allowed to go through. This isn't guaranteed. It's possible the return won't go through and you'll be asked to correct it.

Hi, I got married and haven't changed my name. I have filed my taxes already under my maiden name. I was wondering if I decided to go and change my name now before getting my refund, will it mess up my refund or delay it in any way…. Thanks

Hi Kelcey. When you change your name with the SSA they'll notify the IRS. It shouldn't negatively affect your refund as the two agencies work in concert with one another and understand that name changes are a frequent occurrence year round. Something to consider is if you change your name with your bank and your refund check is cut in your maiden name, will you have trouble depositing it? Most likely no, but something to think about and perhaps ask your bank about.

My mother filed my taxes through Tax-Act – When she entered my name she put in my maiden name instead of my married name. I have had 2 last names since my maiden name was used filing taxes. My return was accepted by the IRS and I already received my refund. Do I have to notify them of the error or just file my return next year using the correct last name?

Hi Jennifer. You can file it next time with the correct name. When there's a name mismatch, the record is flagged for manual review. When a human looks at it, they can often bridge the two names and allow the return to go through.

Hi I married my husband in 2015 and haven't gotten my name changed can we still jointly or do we have to file married but separate.

Hi Jaden. You can file as either married filing jointly or married filing separately. Whatever you choose, you must specify your marital status as married.

My husband and I were married 2 years ago but I have not changed my name to my married name. We would like to file jointly this year are we able to do this? Or does my name have to be changed to my married name?

Hi Lora. You can file jointly without changing your name.

I haven't change my name through social security yet, but I filed taxes under my married name. my taxes were rejected..I'm going to change my name tomorrow what would the next step be to make sure I get my refund?

Hi Julie. You'll have to refile.

Hi, I got married in September 2016 but haven't yet changed my last name bc I'm doing a wedding ceremony on our 1 year anniversary and that's when I would have officially changed everything. My W-2 has my maiden name and so does my SS card. Can my spouse & I file our taxes as single or should we do married filing separately?

Hi Shareasa. You wouldn't file as single. You'd either file as married filing separately or married filing jointly.

I am married and when I efiled it wouldn't take my married name only my maiden name and w2 s are under my married name. Now it's under review. What will they do

Hi Alk. It'll undergo manual review. If they're unable to resolve it on their end, you'll be contacted to make corrections.

If i got married in August 2016 and have not changed my name on anything including Social Security can I file single or do I have to file married? Everything we own is in my name and his name is not on anything. I read that if we file married filing separately he has to itemize as well yet he has nothing to itemize.

Hi Stephanie. You can't mark single, as that's no longer applicable to you. You must mark your marital status as "married", although you can file as "married filing separately" instead of "married filing jointly."

I have a question I changed my last to my married name back on October 2016. Also did changes on Drivers License and SS card and my passport. Everything matches including my W2, now this is my first year filing jointly with my husband. Will I have a delay on my return this year by being my first time filing together. I called because I filed my return on 2/21/2017 it was received and accepted that same day. Now I called and they told me it was going to take an additional 2 weeks to process the return. What can the problem be?

Hi Laura. There doesn't appear to be a problem. If you're expecting a return, it could take up to three weeks, which is not abnormal. You can look up the status of your refund using the where's my refund tool on the IRS website.

I have question I changed my last name with the SSAafter being married that was in September 2016 I filed my taxes on 2/14/17 as did my husband his refund has been approved mines however is still in the processing stage I'm worried that I may still have to verify my identity should I call them?

Hi Yolonda. Delays could be the result of a name mismatch, such as the name on your SS card not matching what you submitted. If not that, then it could be for a variety of other reasons. You may have to contact them to get the current status.

I have a question, I got married January 2017. Do I file my taxes on my own or should I file joint with my husband? I've heard that if I file joint I may have issues with the IRS since I wasn't married in 2016 for the year that I am filing taxes.

Hi Jocelyn. You can do either. You can file as married filing jointly or married filing separately.

Hi, I got married in May of 2016. I filed with Social Security and changed my name over in July 2016. I filed jointly with my husband and used my new married name. I e-filed our return on Feb. 1st 2016 and it still shows processing. Would there be a reason why it is taking so long? We only had W2's for our return. However one of mine still had my maiden name on the W2. Could this be what is holding up the return?

Should I try and send in a paper file return with a copy of my marriage certificate and the W2's?

This name mismatch could be a reason. Your return could be flagged for manual review. Whether it'll pass or get rejected is unclear. You'll have to contact the IRS to determine the status.

A corrected W2 would make sense.

I was notified by the IRS that I never filed a return in 2012. I have since been divorced and been going by my maiden name for the last 4 years. The information on my 1099 form under 2012 transcript shows my married name. What name should I use on my W-2?

Hi Holly. You'd use the name that matches what's on your most current social security card.

I have a question I got married in 2016 of November and I have not received my wedding Marriage certificate nor have my wife changed her name with social security so when we file can we still file married or Jointly?

Hi Andre. You'd mark your marital status as married. How you file, is a separate matter. You can file married filing jointly, or married filing separately.

Hello I'm wanting to know if me and my husband got married Aug 5 2016 so we have to file together?

Hi Monica. No, you don't have to file together. Both of you can file as "married filing separately."

I got divorced and I change my name back to my maiden name but all my W2 say my married name I see that you're saying we need to file a w-2c form with all of my employers but do they give that corrected form to me or do they file it themselves and I still use the W-2 forms they gave me? Also is the form going to be exactly the same except with my corrected name and if so can I already file my taxes with all the same information and just Mark that they are corrected W-2 when I file online? Or do I have to actually wait to get all need W-2s from all of my employer's?

Your employers will not submit the W-2C to you. They'll file it themselves and reissue you a corrected W-2.

Other than the correction, they'll be the same. If you're confident you'll get the corrected W-2 before tax day or when you have to file, then it's a good idea to wait. If you don't think you can get it in time, you can request an extension. If you can't wait and must file with the old W-2, you can submit an amendment later.

I filed my taxes under maiden name they have been accepted by the IRS.. Can I go in and change my ss to married last name.. If so will it effect my return?

Hi Janell. You can change it. The SSA will notify the IRS when your name is updated to keep both institutions in sync.

I received my divorce decree and changed my name 24 hours later.

Unfortunately this happened in November, so my W-2's have my married name and not my maiden name I got back. My name is changed on my SS and DL. I have to file as my maiden name. Will it matter my W-2's are with my married name?

Hi Caroline. Yes, you'll want to get them reissued and up-to-date.

Hi, I tried filing my taxes electronically and they were rejected because I got married and never changed my last name with the SSA. I went and changed my last name and they said it would update overnight and the IRS would be able to see it the next day. I tried to file again the next day and it still rejected it with the same error, I not have time to mail it in what should I do?

Hi Taisha. You can contact the IRS to inquire. If it was successfully changed with the SSA, they do auto-notify the IRS to update their records.

I got married in January. I filed my taxes under old name, they've been excepted online. Can I change my name now? Or do I need to wait til I actually get my return?

Hi Jessica. You can change it now since the filing is complete.

Me and my wife got married but she has not changed her last name yet so she wanted to know how she would file . Would she put single or married

She'd put marital status as married, whether or not her name has changed.