Household Roles and Rules After Marriage

Whether you've just moved in with your new spouse or you've lived together for some time before marriage, the marriage ceremony changes relationships. You must adjust to an entire life ahead, sharing space and duties with your new partner.

Laying the ground rules

The rules and roles in a household are important to establish upfront so you and your partner can avoid resentment and share duties in a way that feels fair to everyone.

This discussion will be more complex if children are involved or your household is blending kids from prior marriages. It can be tricky even when there are no kids in the picture.

Consider these questions to discuss with your spouse during a quiet time. Make sure you can agree and compromise.

Both should come away satisfied and heard. Neither should feel like undue sacrifices are theirs alone to absorb and carry out.

1. Who will work and when?

This is one of the most important things to settle upfront. If you have an uneven job schedule, work a shift job, or care for anyone at home, you should establish who's working and when.

Regular office hours make this more predictable, but you may still need to decide who handles lunchtime dog care or works longer for Friday off when the kids have half-days at school.

If one of you needs to manage a home-based business, agree upon working hours so you know who's free to run errands at particular times or clean the house.

2. What are each of your strengths?

If your spouse is more talented with a wrench or you burn everything you try to cook, the answer to this will be obvious. You may have similar or complementary talents.

If your skill sets are identical, consider learning more household maintenance tasks or see if one of you is interested in, for example, buying a cookbook to learn to make simple meals.

Remember, there will be times when you may not feel like doing stuff around the house, even if you have a knack for getting housework done.

Individual tasks might be boring or annoying, but make sure not to let the un-handy partner in the relationship fix the sink or the easily distracted one cook.

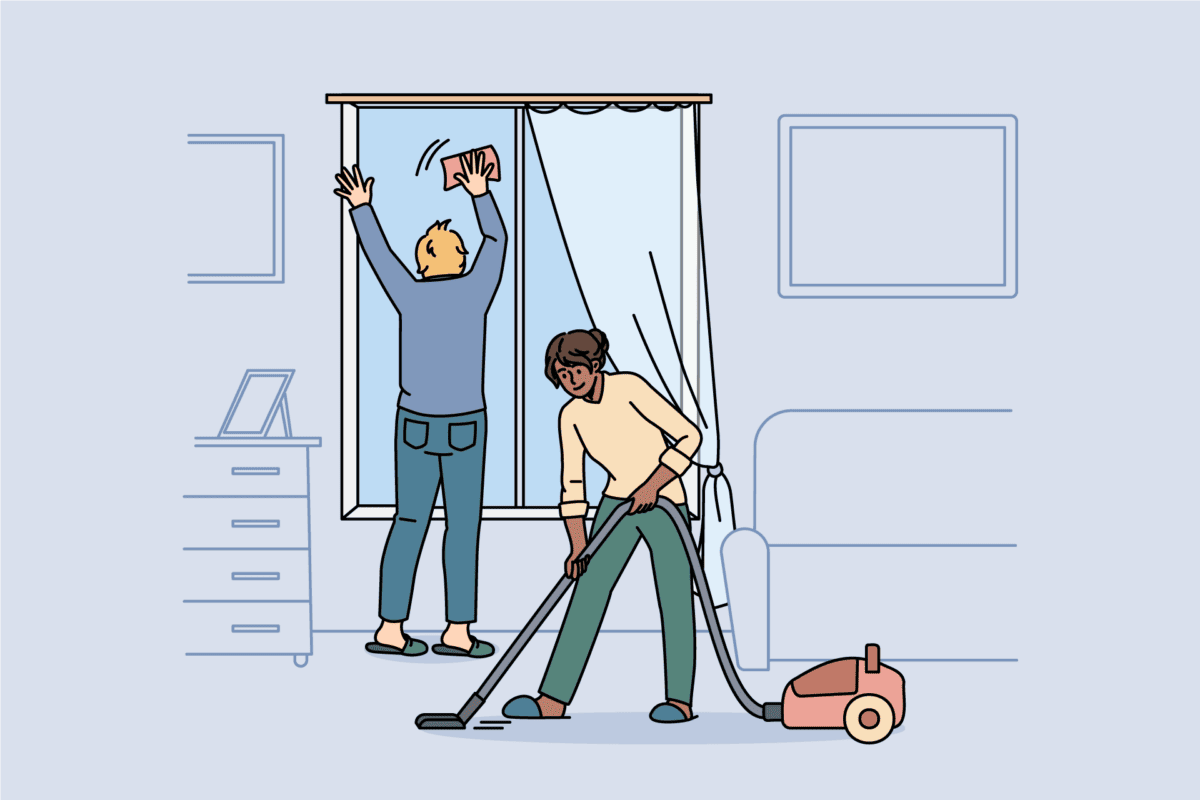

3. What needs to be done?

Work together to compile a list of common tasks. For example, dishes, laundry, and vacuuming are some of the most typical household chores.

If one partner stays home while not working from home during daytime hours, it makes sense for them to do most of the chores, but not all the work or bitterness may ensue.

It can help balance out the load if the working partner commits to doing a few chores, like washing the car on weekends or grocery shopping before coming home from work.

Keeping the home running can be just as much work as going to a traditional job. The same goes for stay-at-home moms and stay-at-home dads.

4. Do you have any rules you need to establish?

Every individual has personal quirks. Some people can't fall asleep with the front door unlocked, while others might need to wash the dishes before going to bed.

Your partner might be very sensitive to cigarette smoke or you might enjoy entertaining many people at hours when your partner prefers to sleep.

Brainstorm a list of things important to each of you, including noise-free time in the household or whether to communicate in advance before bringing friends or family home.

Elevate and make a note of specific tasks or chores that are important to stay on top of to avoid distracting and worrying you.

Even if it seems trivial to you, it may be very important to your partner, so show respect for their suggested rules and try to work out a compromise together.

One example of a way to give and take on rules is during friends' visits…

If one partner enjoys having company over on Fridays while the other works on Saturdays, you could limit the time, making sure guests leave the house by a certain time.

You might decide on "quiet hours" starting at a set time, when everyone in the house needs to bring down the volume to let the other partner and household members sleep.

5. How will you revisit these roles and rules?

Many people have the household roles and rules talk once when moving in together, settling on decisions for years to come. But it's essential for this conversation to be ongoing.

When resentment builds up without designated times for dialog, it can boil until it erupts in a startling confrontation between the both of you.

Rather than wait for the inevitable collapse, you can get ahead of the damage by making sure both of you express your needs and expectations in a loving, gentle, rage-free manner.

Set up a regular date—whether once a month or every few months—to relax and discuss what you believe is working and what needs improving in your relationship.

Always listen without the judgment and defensiveness that often arises when an uncomfortable or accusatory topic bubbles up without warning.

Whatever you do, prioritize communication. Consider if your partner yells at you for being lazy, it probably means they feel the household is unbalanced, not an attack on your character.

After the argument, gently revisit the subject. Explore other ways you can help. Air your frustrations in terms of specific tasks you want your partner to do rather than a general attack.

Final household thoughts

The post-marriage honeymoon phase is fantastic in most marriages, so harness the warmth and respect felt towards one another to set up the roles and rules in your house.

By taking this time now, you and your new spouse can avoid resentment and keep the household running smoothly.