IRS Name Change for Married Taxpayers in 2023

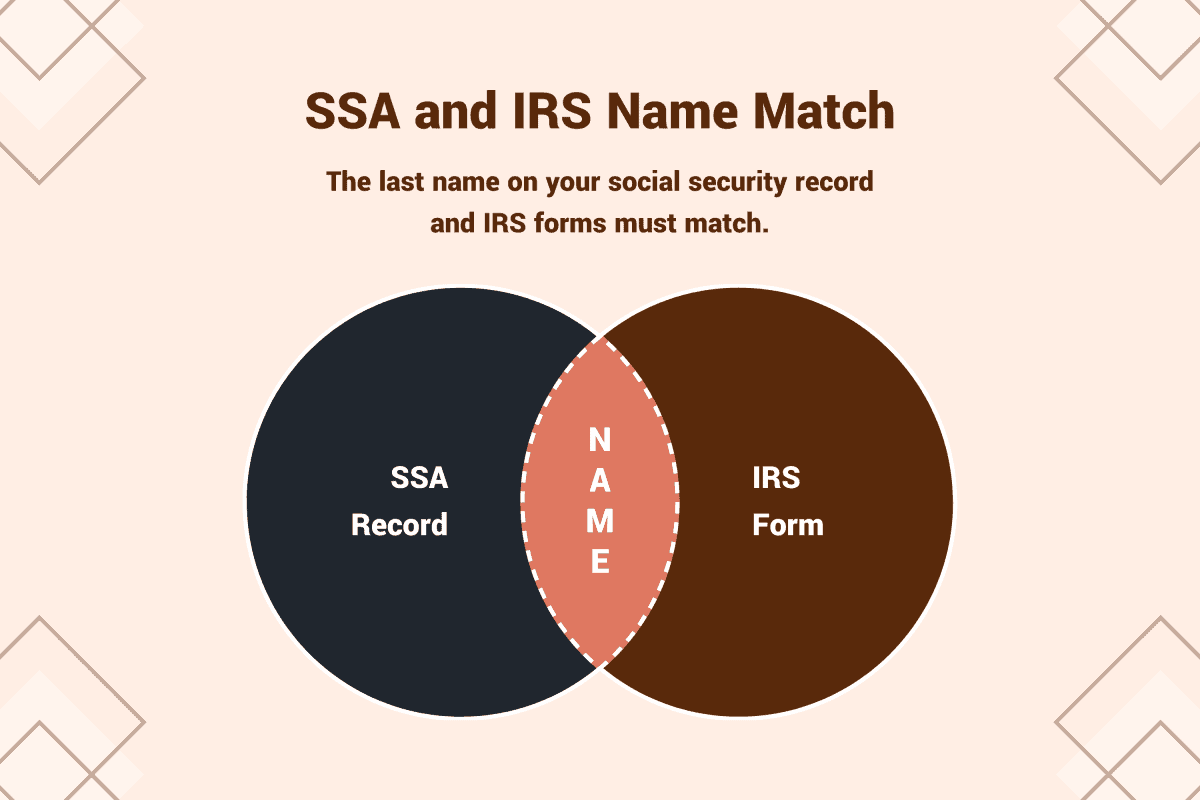

If you change your name after marriage or divorce, you must file your IRS tax return to match the name on file with the Social Security Administration (SSA) to avoid delays.

Delays could flow two ways:

- Processing your incoming tax return

- Sending your tax refund

Yet taxes and name change go beyond the SSA and IRS, extending to W-2s, 1099s, and bank accounts. You need full synchronicity, before, during, and after tax season.

This article will illustrate how best to complete and schedule your name change to prevent holdups, as well as taking corrective steps if an error occurs.

The IRS heard it through the grapevine

The IRS will know when your name has legally changed because the SSA will tell them after updating your social security card. This is an automatic alert.

Therefore, changing your name with the IRS starts with changing your name with the SSA. But the process does not end there. You need to warn your employers and banks too.

This SSA data exchange shares your personal information with the IRS and other federal, state, and private institutions. (And the IRS shares data right back.)

Note: You can use our online name change program to complete your social security to IRS name change paperwork, among others.

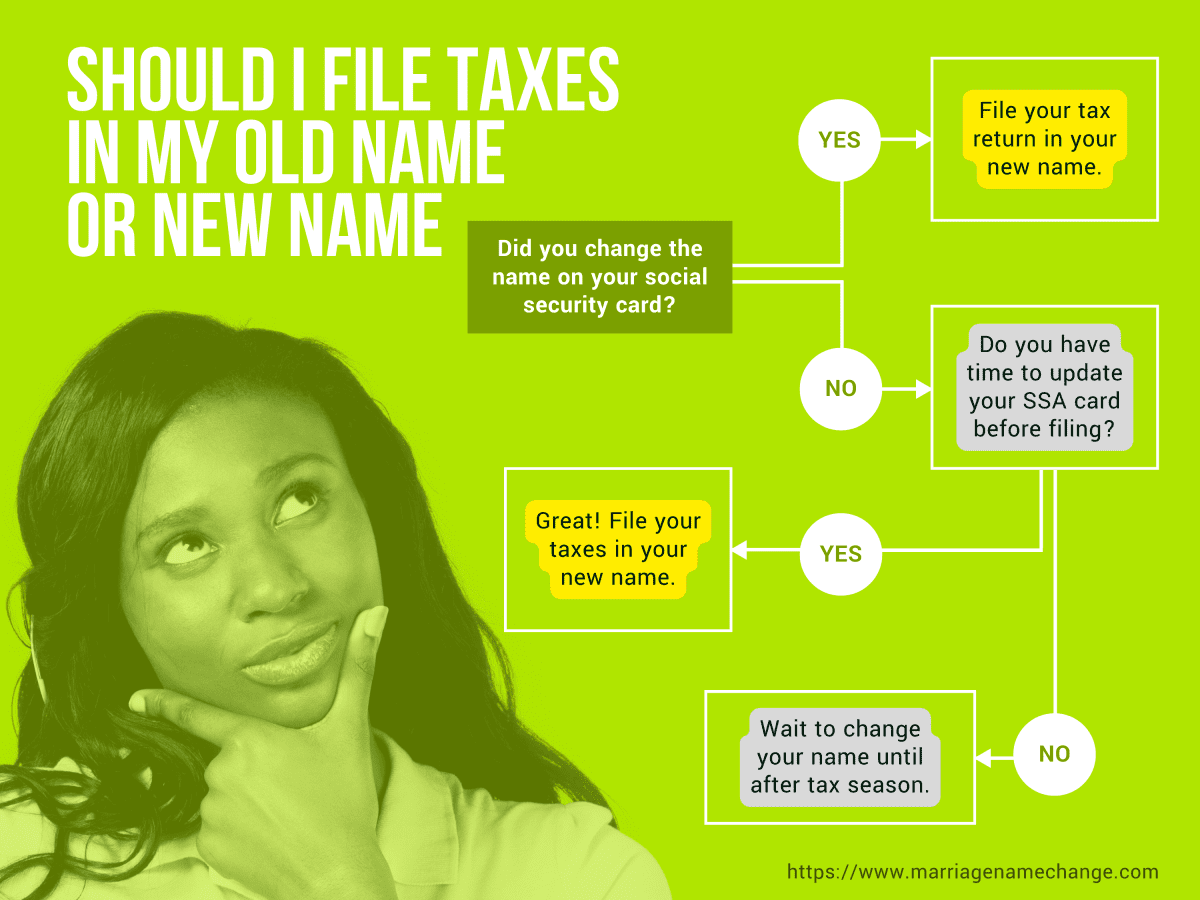

Name change before or after tax season

You should change your name before filing your tax return if you are sure your social security card, W-2s, 1099s, and bank accounts will show your new name.

Otherwise, it is safer to wait to change your name until after the IRS accepts your tax return. It is even safer to wait until after the IRS approves and deposits your tax refund.

Note: It takes 7 to 14 calendar days to get your new social security card by mail, so account for this time frame when filing your taxes.

When are taxes due this year?

Federal income taxes are due on Tuesday, April 18, 2023, at midnight, in your time zone. But the IRS extended the filing deadline for disaster-area taxpayers in the following states:

- Alabama, California, and Georgia — Taxes due October 16, 2023 for natural disaster areas.

- Arkansas — Taxes due July 31, 2023 for tornado and severe storm areas.

- Florida — Taxes due February 15, 2024 for Hurricane Idalia-affected storm areas.

- Hawaii — Taxes due February 15, 2024 for wildfire victims.

- Indiana — Taxes due July 31, 2023 for FEMA-designated storm areas.

- Mississippi — Taxes due July 31, 2023 for tornado and severe storm areas.

- New York — Taxes due May 15, 2023 for winter storm areas.

- Oklahoma — Taxes due August 31, 2023 for wind, severe storm, and tornado areas.

- South Carolina — Taxes due February 15, 2024 for Hurricane Idalia-affected storm areas.

- Tennessee — Taxes due July 31, 2023 for wind, severe storm, and tornado areas.

The IRS will verify your name change

The IRS will confirm the last name on your tax return matches the last name on your social security record by running a computerized query against SSA-provided datasets.

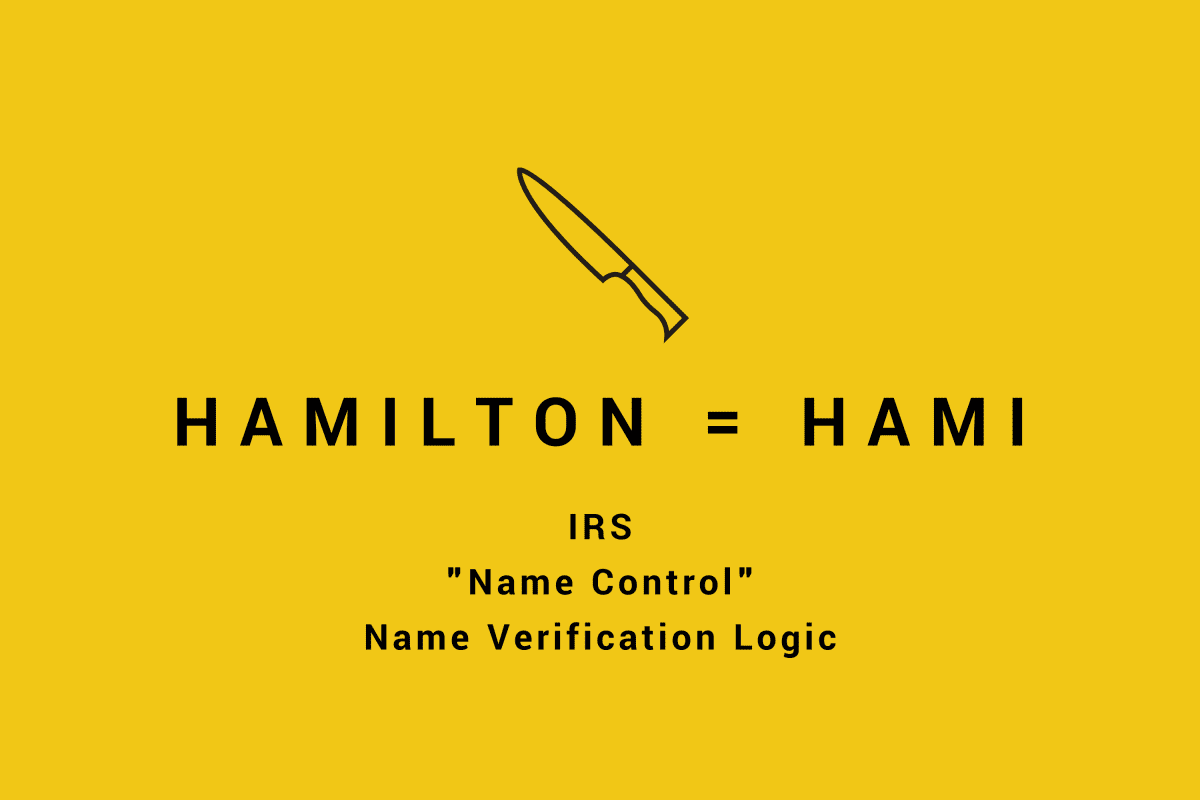

It may surprise you that the IRS will only try to match the first four characters in your last name and not your full name.

These four characters are called the "name control." Your name control may contain letters (A-Z) and hyphens (-). (They will strip away other characters.)

IRS name control matching is very lenient:

- For example, if your last name were Brown, your name control would be "BROW."

- Yet if you spelled your last name Browning, your name control would still be "BROW."

Your name control is used to match against your social security record along with your social security number (SSN). Mismatches can hinder processing.

Note: The preceding name control rules are specific to a person's name. Business names extend the above rules to allow ampersands (&), exclude the term "DBA," and ignore the word "The" when used at the start.

Advantages of e-filing and name change verification

Electronic filing (e-file) offers a key benefit over mailed paper filings: real-time name validation. If the IRS reports a name mismatch, you can try again until you fix the error.

According to the IRS, for Fiscal Year (FY) 2021, electronic filing made up 90% of the 151.1 million individual tax returns filed.

What about spouses' and dependents' names?

Social security number and last name verification will apply to everyone listed on a tax return, including the primary taxpayer, secondary taxpayer, spouse, and dependents.

Any name discrepancy will trigger a rejection. An e-file name control mismatch error will prompt you to recheck your input data and try again.

What about accented characters?

If your name has accents or diacritical marks, file your tax return using the letter equivalent. For instance, if your surname were Gómez, spell it Gomez instead.

Notice how the "ó" becomes "o" in Gómez. The name control becomes "GOME."

What about apostrophes?

It does not matter whether you keep or drop an apostrophe in your name on your tax return. The IRS (or your tax preparation software) will do a silent removal.

If your last name has an apostrophe, IRS computers will cut it. For instance, if your last name were O'Leary, the IRS will convert it to OLeary with a name control of "OLEA."

Unlike the IRS, SSA records allow apostrophes in last names. IRS systems account for such disparities, so this will not provoke a name mismatch.

What about short last names?

Your name control can have less than four characters, but it must start with a letter. So a last name of "Li" would cause a two-letter name control of "LI."

What about hyphenated last names?

If your name is hyphenated, the IRS will use the first four characters of your hyphenated name (including the hyphen) as your name control.

Example 1: Dangling hyphen

For instance, if your last name were Lee-Mitchell, the IRS would match against "LEE-" with the hanging hyphen as the fourth character of your name control.

Example 2: Middling hyphen with apostrophe

However, if your surname were O-D'Angelo, the IRS would use "O-DA" as the name control—keeping the hyphen yet dropping the apostrophe.

What about last names with spaces?

If your last name has a space, the IRS will remove it. For instance, if your last name were Van Hollen, the IRS will flatten it to VanHollen to achieve a name control of "VANH."

You do not have to remove spaces from your name on your tax forms or tax return. The IRS will remove them during processing.

Name and address change

If your home mailing address has changed, file IRS Form 8822 and note your old and new name. Filing Form 8822 should not wait until tax season. Do it upon moving.

IRS-sent mail and paper tax refund checks will get lost if you do not alert the IRS of your new mailing address, which can be a home address or P.O. Box.

Employees and W-2s

Tell your employer or HR department when you change your name. The name on your W-2 form must match the name on your social security record.

Your employer may need to see one proof of name change:

- Updated social security card

- Updated driver's license

- Updated passport

Or just proof of authority to change your name:

- Marriage certificate

- Divorce decree

- Court order

Filing taxes with a W-2 that is under the wrong name can lead to delays in processing your tax return and the receipt of any tax refund due.

What if your W-2 shows your old name?

If your employer issued you a W-2 under your old name, contact them for a corrected W-2 in your new name. They are required by law to comply.

Getting a corrected W-2 applies to current and former employers. If they refuse your request beyond February 2023, the IRS can force their hand with a Form W-2 complaint.

Accountants and employers can verify employee names and social security numbers online using the free Social Security Number Verification Service (SSNVS).

Self-employed freelancers and 1099s

If you are a self-employed freelancer, gig worker, side hustler, affiliate marketer, or independent contractor, tell your associates to update your name on any IRS 1099 form issued.

If you receive a 1099 in the wrong name that does not match your social security record, processing of your tax return and tax refund could get delayed.

What is a 1099 form?

A 1099 lists how much money an entity or person paid you during the last calendar year. (1099s are not for employers and employees—those use W-2s instead.)

For instance, if you owned a website that promoted ACME Inc's products or services for commissions, then ACME Inc. would issue a 1099 form.

In this scenario, ACME Inc. is the "payer" and you are the "payee." You should get your non-employee 1099s by mail no later than January 31st:

- One 1099 copy to you

- One 1099 copy to the IRS

A payer could be anyone who sends you money:

- A client

- A friend

- A company

- But not an employer

Will you get a 1099 if you made little money?

Payers are not required to issue 1099s to non-corporations whose earnings or payouts were below $600 for the prior year.

Although payers can issue 1099s for payee earnings below $600, they often do not because it means more tax paperwork and burden for them.

Correcting the wrong name on your 1099

The name on your 1099 must match your social security record, same as a tax return, and same as a W-2. Otherwise, delays may ensue.

1. When you find an error

If you notice the wrong name or information on your 1099, tell whoever issued it to send a corrected 1099 to you and the IRS.

2. When the IRS finds an error

If the IRS spots a mistake on your 1099, they will alert the payer who issued it. The payer should contact you for a correction and send the updated 1099 to you and the IRS.

Update your bank account to match

You may face trouble cashing checks or receiving ACH direct deposits if the name on your check or direct deposit does not match the name on your bank account.

This problem goes beyond tax refund checks and direct deposits. It can affect your regular paychecks too, whether paper or direct deposit.

But your bank routing and account number is right

Here is an eleventh-hour nightmare sequence of events:

- Social security card, updated

- Employers, notified

- Clients, notified

- W-2s, done

- 1099s, done

- Tax return, done

- Name on bank account, unchanged

- Bank routing and account numbers, unchanged

Good enough, right?

- No, that is not good enough.

- You needed to tell your bank your new name.

ACH direct deposit payments may get rejected by your bank because of a name mismatch, even when your routing numbers and account numbers are correct.

Yes, that's numbers, plural, as the IRS allows you to split a tax refund direct deposit into up to three different bank accounts owned by you or your spouse.

Deposit rejection is harsh, but understandable:

- Rejection avoids depriving the true recipient of monies due.

- Rejection avoids a time-consuming investigation.

- Rejection avoids reversing a settled deposit.

- Rejection avoids IRS intervention.

You forgot to update the name on your bank account

The IRS will mail you a paper check if your bank rejects a direct deposit tax refund due to a name mismatch between the endorsed name and account holder's name.

In order to cash or deposit your incoming paper check, you must still change the name on your bank account to match the check's "pay to the order of" name.

You can use the IRS' Where's My Refund tool to check your tax refund status.

Tip: Your bank might accept a check in your old name if you present your marriage certificate, divorce decree, or whatever document prompted your name change.

Conclusion

The only thing scarier than doing your taxes is doing them with the wrong name. One name change inconsistency can invite chaos, causing tax return and refund delays.

So if you are transitioning to a new name, make sure you update it everywhere that matters, from your social security card, W-2s, and 1099s, to your bank account.

Your future self will thank, your accountant will thank, and the IRS will thank you.

Hi, I got married in July 2016. I have not changed my name with the ssa or any where else. Would I still file single since I haven't changed my last name any where?

Your name change (or non-name change) wouldn't impact how you file. Although you have to specify your marital status as married, you can opt to file as married filing separately.

I was married on 4/15/2001 and became a victim of identity Theft in 2010 and 2011 and they continue to make me file in my maiden name.my ssa , drivers license and my whole life is under my married name. However I sent all my verifications in to them. I filed my married name instead of my maiden name by mistake on tt this year. Will this delay me? I have a pin they send me each year to use and I did. Also my driver's license and social security card I sent them has my married name on it. Will they make me amend or send the same info in again? Please help

Hi Nina. The IRS goes by what's on your social security record, so I don't see where a problem will arise.

My husband and I got married in September, and all my forms are still my maiden name as I haven't changed it with the SSA. When I got put on my husband's insurance, they mistakenly changed my last name to his, and on the insurance form for taxes he got back from his employer it lists my married name, not my maiden name like my other tax forms. Will this be an issue?

Hi Janelle. It may be an issue. Your husband can request his employer correct their records and reissue the documents.

I changed my last name on December 29th 2016. I never received a new social security card. I applied for a credit card about 3 weeks after my name change and it was unable to find my information. When I used my maiden name it went through without any problems. For that reason I used my maiden name for our taxes. The taxes were accepted – does that mean my name doesn't appear to have been changed?

That appears to be the case. You'd have to contact the SSA to determine for sure if they even received your documents.

I got married January 22,2016 and changed my last name with the SSA not too long after but haven't changed my last name with the DMV, my w-2s will have my married last name on them, since this will be our first time filing taxes since we got married so we just wanted to know can my husband and I still file separately as we always have been before we got married or now that were married and I changed my name we have to file together?

Yes, it's called "married filing separately."

Even if I changed my name with the SSA I can still file separate from my husband? I only ask cause my tax preparer said since I changed my name we have to file together.

Yes, you have two options: married filing separately or married filing jointly.

Got married in 2016 but haven't changed my last name with ss yet but w2s came with married name and my bank and I.d. has married last name on it do I file married with Maiden last name or single with maiden last name… Before I file taxes

Hi Tabitha. Taxes are filed matching the name on your SS card. You can try to get your W2's amended.

I got married on 1-4-17 and have changed my last name with the SSA. When I file my 2016 tax returns (as single) would I use my maiden name since I was single in 2016 or my married name since my name has now legally changed.

Married name.

Hi! I have the same question now, I would like to know if you filed your taxes with you married name ? and also, if you sent your w-2 with your maiden name.

Thanks

Hi Pris. You should file your taxes using the name on file with the Social Security Administration.

I am a caregiver, and my client just informed me that although he legally changed his name over 10 years ago, his accountant has been filing returns with his old name. My client showed me his proof from the Social Security office of the name change. When I asked my client why the accountant says she's filing his returns using his former name, she says it doesn't matter and that it goes by the social security number not the name of the person, which is the most ridiculous thing I've ever heard. Thoughts?

Hi Karen. The Social Security Administration keeps a history of all name changes. Anytime a name change occurs, the IRS is notified. They're kept in sync. When taxes are filed and a name mismatch occurs that can't be resolved programmatically, it has to be manually reviewed. During the manual review, it's likelier than not the agent is able to see why there's a slight mismatch and will just push it through. It wouldn't be surprising if his record has been notated to reflect this.

I have just gottan married in july of 2016 i havent changed my last name on anything and we are filing separately can i still use my maiden name

Yes, that's the name you would have to file under.

Ive been married for 3 years but now recently separated since March of 2016. Do I need to alert the IRS and how should I file now. Note I never had my last changed

Hi Arica. If you have a decree of separation maintenance before 2016 ended, then you may be able to file single. Otherwise, you'll be considered married and can opt to file as married filing separately.

I'm getting married Dec 17,2016 but I want to go ahead and start my taxes shorly after that, If I file taxes before I get my name change will it get delayed by waiting to change my name and social security info until I am approved for taxes?

Hi Jenna. Since the SSA notifies the IRS when their records reflect a name change, the transition should cause a problem. Still, you may want to get in touch with an accountant or query the IRS's toll-free line for assistance.

My husband n I are Married but I have NOT changed my last name yet and can we still file "Married this 2016 Tax Year?" or do I need name change ?

Hi Darlene. Name change is optional. It won't affect how you decide to file.

How do I get my name changed on my retirement fund? Change due to divorce.

Hi Emily. Once you've changed your name with the SS office, contact your financial institution to change it with them. Gather information about what identity documents they require.

Will they need only your social security number to run a name/identity check, or do they need additional credentials, such as a driver's license. How may credentials? If you can't supply all they need, will they accept secondary credentials?

Will you need to supply proof of your name change, such as a copy of your divorce decree? Does the divorce decree need to be a certified copy or can it be a photocopy? Does your divorce decree contain an order from the judge restoring your name? If it does not, and they require it, can you get your decree modified? If you need to get your decree modified, but can't, how will they accommodate you?

Will they need to permanently keep copies of your certificates (e.g., birth, divorce) or will you be able to retain them?

Can you change your name with them by phone, mail, online, or in-person. Each institution's procedure is their own, and you'll have to follow what they've put in place.

I am a retired employee of IRS and my pension check is direct deposited into my bank account.

I need to change my name with the IRS Pension Dept. The bank said they can't do it you have to..

My health insurance payments are deducted from my pension and I am unable to correct my name on my insurance card. I've been to the Covington officeon 4th St (this is where I worked and retired from) and to the Cincinnati office at 5th & Main. I was told they can't help me and don't know who I should contact. Please let me know how I can get this fixed. Thank you.

I left a message. Where did it go? I need HELP to change my name on my pension and health insurance card.

What are you wanting. I have commented twice.

I messed up my new name. It is Kampsen. Sorry.

Hi Emily. Just to be clear, this site is not the IRS website, nor related to it, so if you need direct assistance you'll have to contact them direct. Having said that, are you saying the IRS only has reference to your old name? Have you updated your name with the SSA? They notify the IRS of a name change when your social security record is modified. When you tried to change your name on your insurance card, did you provide proof of your name change, such as an updated SS card and certified copy of your marriage certificate?

I got married 5/7/2016 I changed my name with Social Security Administration and Drivers License. I have provided my employer with the necessary documentation 3 times and they still have not changed my name. Is there anything I can do?

Hi Sarah. Your employer won't update your name within their internal records? If so, has a reason be given. If you need your W-2 to be properly updated, you can contact the IRS and have them initiate a W-2 complaint on your behalf.

we got married 15 years ago never got wife's named changed with SSA, getting ready to do so now. My question is when we do get it changed . will the IRS back date it to the date of marriage or go with the date they get notified?

Notification date.

I changed my name legally to my Married name, SS and all and filed with my married name but NYS sent me an IRS notice with my maiden name, should i be concerned?

Hi Isabel. Best thing to do is to contact the NY State Tax Dept. and have them update your record.

I got married and separated in the same year (please don't judge) and I never changed my name. Can I file single or married filing separate?

Hi Tonya. Your non-name change wouldn't affect your filing status. File as you previously did.

I got married 5 yrs ago and never changed my name on my social security card. Do I just have to fill out a form to get it updated?

Hi Jen. Form SS-5. You can download it online or pick one up at your nearest SSA office.

I got divorced March 1st 2016 and changed my last name back to my maiden name right away – have gotten my new SS card with maiden name on it. Since I was married all of last year and W2 form has my married name on it, which name do I file taxes under this year??

Hi Sarah. Maiden name. Try and get your W2's modified to reflect your maiden name to prevent a name mismatch.

Hi there,

I was married in Jan. 2016 and have changed my last name with the SSA. So, based on this article and the comments, I should file my taxes under my new married name, but does it matter that all of my tax documents (mortgage forms, W-2s, stockholdings, etc.) are still under my maiden name? Won't that also be confusing to the IRS, especially since I still technically have to file as "Single" based on the filing rules?

Thanks for the help!

Hi Kristin. Your W-2's may need to be updated, but it's not a given it'll be rejected as-is. In some circumstances, a name mismatch can undergo a manual review and allowed through without your ever knowing there was a potential problem. The IRS, along with the SSA, maintains a prior name history that can be referenced.

I got married in December 2015, but just changed my name through the SSA on 3/10. The W2 has my maiden name on it. I've notified my employer of the name change which they cannot process till the new card comes in. Should I be filing my taxes with my married name or my maiden name, since the taxes are for 2015? And how long does the name change on the W2 take, do I need to wait for it to file?

Hi Cokie. You'd file with your married name. It's unclear how long it takes SSA to alert IRS of a name change, but it is an automatic event. If you're having difficulty with your employer processing your name correction in a timely manner, you can get assistance from the IRS by calling 800-829-1040. This number is available after Feb 15 and is also good for those who need corrected W2's when an employer has gone out of business.

I got married in February of last year and almost immediately got my last name changed on my Social Security card, but have yet to change my name on my drivers license or any others like mortgage. Would I file my taxes under my new married name? And would not having it changed on my license/bills affect anything?

Yes.

No.

I just noticed my tax preparer has been using my maiden name the past 3 years on my tax returns. I brought it to his attention but he made it seem like it's not a big deal because it went through- and it wouldn't have gone through if it didn't match. However, I know it's been changed, and I have had my new ss card with my married name on it. Is there anything I need or should do, or is it ok like he said?

Thanks!

Hi Samantha. If it went through, then you're okay. For future submissions, it's best to use the current name reflected on your SS card.

I changed back to my maiden name last month and have not filed taxes yet. My w2 form has my married name. Which name should i file my taxes with? Also, do you know how it will affect my child's fafsa application?

Hi Kim. Married name. Shouldn't affect FAFSA as long as the current name is used.

Hi my husband and I have been married for only two months now, I changed my name with the Social Security on Feb 2nd,2016. He filed his taxes as married but filed seperately and he put my maiden name. He filed on Feb 5th,2016.

Will that delay anything? or should he contact Turbo Tax which is how he did his taxes or contact the IRS?

Hi Vanessa. It's possible you may face a delay. TurboTax's website provide instructions for how to correct a filed return, if you've used their software. You can also try phoning the IRS to determine if you'll need to submit Form 1040X to amend your tax return.

One of my dependents had one last name all off last year except for the last 12 days or so in December, but did not change with SSA until after the 1st of the year, when I filed my taxes on Feb 4, 2016 I did not change the persons last name to the new last name, can this affect my return?

The WMR says that they are being processed but they were accepted on the 5th.

It could possibly affect your return. Are you seeing a personalized refund date yet? It could take up to 21 days to determine if your refund is accepted. When it exceeds 21 days from the date you filed electronically, you can contact them to see the status of your refund.

I filed taxes using my maiden name and went to the social security office a few days after to change to my married name. Will this affect my tax refund with the IRS since I changed my last name after I filed taxes?

Hi Stephanie. It shouldn't be a problem, as you completed the name change after, not before, you filed.

I got married in July 2015 and took my husband's last name but have not changed my social security number yet and have yet to update the banking information. Can I file my taxes with my maiden name and file as married jointly? Since we are expecting a refund, should I change my SS# after I file and immediately update my bank information so that the tax return is not denied by my bank? What order should I do this in?

If you're in a time crunch, you can wait to change your name, then file using your maiden name only. You'll use your maiden name even if filing jointly.

Your SS number stays the same after a name change. If you're referring to the name on your social security card, you can wait until your refund is deposited, then change your name with the SSA and your bank.

I got married in November 2015 and changed my name with the social security office soon after. I was misinformed and thought I needed to show my employer my license which I didn't change until Jan 2016. They didn't have my updated info and my W-2 came in my maiden name. My employer just said to file my taxes and it would be fine but from what I'm reading, I might be in trouble here. I asked about the W-2c form and they said that's only used if my wages were wrong. What should I do?

Hi Briitney. You can have them submit Form W-3c as well to correct your name.

I got married a few years ago and only changed my state ID to my married name. I never changed my SS because i didn't know i had to, plus we're seperated but not divorced. I filed and it was under my maiden name but state id says married name. Is there going to be a problem because of this. My return has beensaying in process for like 3 weeks now

Hi Nicole. If there's a problem/delay, it wouldn't be because of your name. You're using the right name, which is what the SSA and IRS have on file.

Question i filed head of household as i always do…me and husband separated i never changed maiden name on ss card but my bank card had my married name because of liscense my return was returned to irs by bank now they say im under review how long should this take

Hi Crystal. Amendments can take 8-12 weeks, but you can try phoning the IRS (800-829-1040) to see if they can expedite a name correction, as that seems to be what you're experiencing—using a name that differs from what's on your SS card? If that's not the case, please clarify.

I changed my last name back in April 2015 so well before filing this year. I received my new social security card in April as well. Even my employer updated my W2 to match my new last name. However when I filed and was accepted on January 19, 2016 I thought all was fine. However the IRS is saying there is a delay on processing my return and the only thing they could see that's possibly causing the delay is my last name. Although it was verified with SSA. Is this normal? Can delays still happen although everything was done well before time? How is this possible?

Hi Candace. When you update with SSA, they'll notify the IRS of your name change. Because your application was accepted doesn't necessarily mean that there isn't a name mismatch. It's possible your record wasn't updated. You can get in touch with the IRS (800-829-1040) and get clear confirmation if your name (letter by letter) is or is not correct in their system.

I filed my taxes under my new married name. My married name and txes my SS # and my taxes have been approved. My bnk account thy I am having my return sent to is under my maiden name. Will the return still be deposited into my account as scheduled? Thank you for your help.

Hi Emily. IRS verifies against the bank name, routing, and account number for tax refund direct deposits. If there's going to be a rejection, it would likely be on your bank side, so you'll have to contact your bank to find out if they'll let a name mismatch go through.

If direct deposit of your refund does fail, the IRS will automatically be notified, then they'll postal mail you a paper check.

My society security number matches what i filed under but my w2 has my married name on it, will that mess something up?

Hi Brittany. If the name you're using matches the SSA and IRS records, you're good to go.

Hi I have a question about my irs refund on my health care I have a different last name but under Social Security my last name is the same as IRS would that be a problem

Hi Nicole. If you're referring to an error on Form 1095-A (health insurance marketplace statement), then you can request a corrected 1095-A form.

No talking about a out site of the market like Medicaid will that delay your refund different last name on both

Hi Nicole. You can contact your Medicaid caseworker, request a Change of Information Form, then submit it (by mail or in person) with your updated name. You'll get a new Medicaid card with your correct name info.

It's doubtful this would impact your return, but since this is something you'll have to update anyway, you can confirm with your caseworker.

We filed on the 22nd and it was accepted but still hasn't been processed. We were married in October but have not had her named changed at the SSA yet. I filed using her maiden name that's also on her ss card.

I was worried that this was what's holding the tax refund up . We were going to rush down today to get the name change forms submitted but I think it would just complicate things now ?

Hi Jase. If her name hasn't been changed with the SSA, then any holdup or delay isn't name change related. There's something else going on.

Hi, I got married last December 2015 and already had my name changed at SSA last Jan. 19 2016. However, my w-2 is still on my maiden name. Can I file my tax under my married name even though my w-2 does not match with the forms? I will be file as married jointly. Will there be any problem?

Hi Pobee. Employer can use the W-2C form for name corrections.

I got married in Nov. 2015 but my name change didn't get filed with the SSA until Jan. 4, 2016. According to the tax rules I believe I need to ask for a corrected W2 as that still shows my maiden name. I asked my employer for a corrected W2 to my married name, but they said since I didn't correct my name with the SSA until 2016 they can't do it. Calling the IRS, their help "tree" indicates my question can't be answered by a live agent and I need to use their website to find answers…which I can't find! Any thoughts on this — it seems on the W2 form, IRS site, and on your site what matters is that my name needs to match the SSA records at the time of filing, and that is my married name. Not sure what to do if my employer won't provide the corrected form!

Hi Laura. You can request a Form W-2 complaint be initiated on your behalf.

I filed my taxes jointly with my she hadnt had her last name changed through SSA I used her maiden name will that keep us from getting taxes? Also filed on 19th and its now the 2nd I've never had to wait this long what could be the reason?

Hi Samuel. If she hasn't yet changed her name with the SSA, and her maiden name is still what's on her SS record, then filing with the same maiden name was proper. As for the lengthy wait, it wouldn't be the result of a name mismatch.

I got married January 5th, 2016, I have went to the SS office and changed my last name and I have already got my new SS card in the mail, my husband has 2 last names and I took both of them, so my question is do I file my taxes with my new last name and if so do I put both of my last names in or just one them?

Both last names. Match what's on your SS card.

i got married and changed my last name but when i did turbotax it automatically put maiden name from previous years and i forgot to change it..i had two w2, one with maiden name and one with name change.. irs accepted it but will there be problem with them approving it?

Hi Alicia. Phone the IRS toll-free at 800-829-1040 to have them correct it over the phone.

I used an online tax website that I have used for years. I hit "yes" when it asked if I wanted to upload my previous information. I got married almost 2 years ago. I didn't notice that the tax website uploaded my maiden name. The IRS accepted our return but will it now reject it because my maiden name was used? Can I call them to get this cleared up quickly? We need this refund to clear up some medical debt ordered by the court for my husband to pay because his ex quit her job. I am freaking out that we don't get our refund for months causing us serious financial issues. Help please!

Yes, the IRS can correct your name over the phone by calling 800-829-1040.

I got married and changed my last name I kept my old name and added my husbands but I completely forgot about it, when I put my info Into turbo tax it automatically input my maiden name and I didn't pay it any attention… The irs website says accepted will this stop them from approving my return

Hi Season. I take it you've hyphenated or used a double-barreled last name. In that case, it may not be a problem due to the first four letters of your married name being the same as your maiden. If the IRS does later cite a name mismatch, they'll notify you about it so that you may correct it. It may delay your tax refund.

I changed my last name a week ago to my married last name but my w-2 still has my maiden last name what should i file under?!?!?

Hi Maria. Your married name, if you've changed it with the SSA. Your employer can issue a correction by submitting a W-2C form.

My husband and i got married but i havent changed my last name yet, if i file with my maiden name do we still have to put we are married?

Hi Faith. As long as the name you use when you file matches what's on your social security record, you'll be good. If your marital status is being asked, just specify married.

Hi, I changed my name over to my married name on the 5th of January. I went to the ssa office in person to do it. The man told me that it updates over night and I was okay to file taxes using my married name. However when I filed last week it was rejected because the irs aparently didn't get the update. So I had to refile using my maiden last name. My return was accepted the next day on the 14th. But now I'm worried that it will finally update after they have already accepted it. What should I do, or what do you think will happen?

Hi Liz. You should be fine. An update doesn't erase your history, it just supplements it. Back references to your prior name will still be linked to your record.

Why about if my SS card is correct and the IRS is still using my maiden name?

Hi Susan. When the SSA is notified of a name change and updates their records, the IRS is notified of it automatically. If that didn't happen, there's a problem somewhere. Contact the IRS to determine why their records weren't synced. Also, you'll want to make sure your employer is using the correct name when filing the W-2 form.

I changed my name when I married over 6 years ago. I promptly updated all records successfully. My new social security card is correct with my new name as is my drivers license, credit cards, etc.

We always file w/IRS and state tax form using my new/married name but we occasionally receive various notices/replies from the IRS addressed to me in my old name. IRS blames SSA and SSA blames IRS. What should I do?

Hi Cindi. The IRS originally gets notified by the SSA when there's a name change, so it's difficult to say where the occasional mail inconsistency is creeping in. Have you tried calling the IRS at 1-800-829-1040 to try and get help tracking down the discrepancy?

Following Nicole's question how will employers know to send a W-2C if we don't work there anymore? Should we call old employers to let them know that we have changed our last name and to file a W-2C?

Hi Anna. Yes, updating your previous employer is a good idea.

Is that necessary or can you just put your new name when filing your previous job W2 with your maiden name on it? Reason for asking is that I have already changed to my married last name on my social card but have a previous employer W2 that has my maiden name on it. If the IRS and SSA goes by what's on your social is a W-2C even required?

Hi Samantha. Yes, they do go by SS number. But if there's a name mismatch, it may be flagged for manual review/processing. If there's a problem, you'll be notified. Worst case, it'll just delay things.

I have a question. My wife and I got married, and she sent the forms to the SSA to have her name changed, We filed our taxes jointly and used her maiden name. We just got word that our Tax return got sent to the errors dept and we are assuming its because the last name on the tax return doesnt match the name with the ssa. How do we get both on the same page?

well my wife said the the SSA didnt change her last name because we didnt send in a certified copy of the Marriage license.

True. The social security administration requires a certified copy of your marriage certificate. This can be acquired by contacting your local vital records office. So, if your wife's name was not successfully changed, what's the current name on file with the SSA? Her maiden, or a prior married name? Where is the name mismatch occurring with between the SSA and IRS?

Hi Nathan. The IRS goes by what's on the social security record. When you file your taxes, the name must match what's on file with the SSA. So, if you have to refile or have it go through corrections, you'll want to confirm what's on your wife's social security record.

I filed my taxes under my maiden name. I just received notification that the SSA office received my name change application and was sending my new social security card. Will this delay the processing of my taxes??

You should be fine. The SSA will notify the IRS when they process a name change.

I went to the social security office and changed my last name because I forgot about it well I went and changed it with the ssa how long does it take for the irsto get that update

Typically, around 10 days.

i recently got married and hanged my name with the social security i worked 2 different jobs last year and the w2 forms have my old name on them what should i do?

Hi Nicole. The W-2C form is used by employers to make name corrections.

Hi, I'm in the same boat as Nicole. To clarify the response above, do I need to get all of my tax forms with my maiden name updated before I can file? Besides W2s, I have HSA forms and student loan forms with my maiden name. Wondering if I need to request updated forms for everything (hoping not)

Hi Katie. You should try to get them updated to reflect your current name. If you don't think you'll be able to get it done in time, you can either request an extension or file as-is and amend them later.

I have been married for two years but I have only had my husbands last name for a year now. I've changed my SSC, passport, mailing and bank name but I still haven't changed my Drivers licenses (cuz we're moving) and my last name at school. I'm most concerned for my name at school. I will be receiving a 1098-T Form from my school with my maiden name on it. My name on everything else is my married name and I will put my married name on our taxes but my school form will still say my maiden name. Will this be a problem when we file taxes?

It could be. The name you provide to the IRS must match the name on your social security record.